China Semiconductor three-way attack

- Categories:Industry News

- Author:

- Origin:

- Time of issue:2021-09-03

- Views:0

(Summary description)According to the research report of Guosen Securities, in the first eight months of 2020, nearly 10,000 (9335) companies in China switched to the chip industry, a year-on-year increase of 1.2 times. There are currently 62 listed A-share semiconductor companies, and the number of newly transformed semiconductor companies is 150 times the stock.

China Semiconductor three-way attack

(Summary description)According to the research report of Guosen Securities, in the first eight months of 2020, nearly 10,000 (9335) companies in China switched to the chip industry, a year-on-year increase of 1.2 times. There are currently 62 listed A-share semiconductor companies, and the number of newly transformed semiconductor companies is 150 times the stock.

- Categories:Industry News

- Author:

- Origin:

- Time of issue:2021-09-03

- Views:0

According to the research report of Guosen Securities, in the first eight months of 2020, nearly 10,000 (9335) companies in China switched to the chip industry, a year-on-year increase of 1.2 times. There are currently 62 listed A-share semiconductor companies, and the number of newly transformed semiconductor companies is 150 times the stock.

From the perspective of investment, according to the "2021 China Semiconductor Investment In-depth Analysis and Outlook" released by Yunxiu Capital, in the past year, 534 semiconductor companies in the market received financing, with a total financing amount of 153.6 billion; of which financing amount exceeded 5 The number of large projects with RMB 100 million is 46, accounting for only 8.6% in number, but the total financing amount is 99.2 billion, accounting for 64.6% of the total financing amount, and the leading effect is obvious.

From the perspective of revenue, according to the statistics of the China Semiconductor Industry Association (CSIA), the sales of China's integrated circuit industry have increased from 433.55 billion yuan in 2016 to 884.8 billion yuan in 2020, which has more than doubled in five years; 2021 The first quarter of the year continued to maintain rapid growth, with sales of 173.93 billion yuan, a year-on-year growth rate of 18.1%.

Regardless of viewing from that angle, they all said the same thing-the domestic semiconductor market is exploding. And it is every domestic semiconductor company that promotes the growth of this market. Among the many types of semiconductor companies, it can be roughly divided into three categories, which has gradually formed the three forces of China's semiconductor market.

dazzling start-ups

Start-up companies are one of the protagonists of this round of domestic semiconductor boom, especially under the dual promotion of market environment and policies, large sums of funds have also been poured into these start-up semiconductor companies.

According to the incomplete statistics of the Science and Technology Innovation Board Daily, in the first half of 2021, domestic and foreign chip companies including Horizon, Suiyuan Technology, Biren Technology, Hanbo Semiconductor, etc. raised 27 cases, with a total financing amount of more than 20 billion. Among them, cloud AI chips and GPUs are the main theme of these start-up semiconductor companies.

The reason why these start-up semiconductor companies have been favored by the capital market at the beginning of their establishment is that, on the one hand, driven by artificial intelligence technology, the rise of emerging application markets increases the demand for GPUs, cloud AI chips and other products. On the other hand, It is because in these tracks, domestic chip companies have the opportunity to compete with international companies, and the potential value hidden in them has made these startups a force that cannot be ignored in the development of the domestic semiconductor industry.

The rise of emerging applications does not and does not appear out of thin air. They are more like a round of technological upgrades stepping on the shoulders of giants. For example, we see that traditional wireless technology has been continuously upgraded to the Wi-Fi 6 era. Benefiting from the future development prospects of the Internet of Everything, Wi-Fi 6 chips have also become the choice of many start-ups.

At the same time, with the growth of WiFi 6 chips, related RF front-end products are also facing upgrades. We mentioned in the "Lively WiFi 6 Chip Track" that WiFi 6 chips will face more and more in the future. The more segmented situation, therefore, these fields also bring opportunities for start-ups, including Longli Semiconductor, Sanwu Micro and other companies are worthy of attention in this track of start-up semiconductor companies.

In addition, the demand for third-generation semiconductors in the automotive field has also prompted a large amount of funds to flow to related start-up semiconductor companies. Industrial funds represented by Hubble Investment under Huawei and the Hubei Xiaomi Yangtze River Industrial Investment Fund have invested in a number of semiconductor companies involving SiC and GaN. Among them, some companies are preparing to log on to the science and technology innovation board, which has attracted the attention of the industry. .

Catering to the needs of emerging markets is one of the reasons for the increase in the number of domestic start-up semiconductor companies. In addition, domestic substitution is another reason for the increase in the number of domestic start-up semiconductor companies.

As a result, some start-ups looking for opportunities in the traditional semiconductor market have also emerged. Affected by the changes in the trading environment and the lack of cores in recent years, the development of domestic semiconductor equipment provides an opportunity for such companies. According to reports from the investment community, Jiyi Technology, a semiconductor equipment startup focusing on the application of plasma technology, Completed tens of millions of strategic financing.

In addition, the increasingly segmented chip market and customized needs provide many options for start-ups entering the traditional semiconductor market. For example, the analog chip market with many market segments has promoted the emergence of a large number of related start-ups.

Transforming "core" forces

If start-up companies are promoted by a group of people with lofty ideals with considerable experience in the semiconductor field, their appearance has brought new power to the development of my country’s semiconductor industry, then there is another trend toward semiconductors in my country. They are also a new force in my country’s semiconductor industry.

Leading mobile phone OEMs represented by Wingtech and Foxconn have begun to step into the semiconductor field. Chip manufacturing is their breakthrough point in entering the semiconductor field, and acquisition is the method they use.

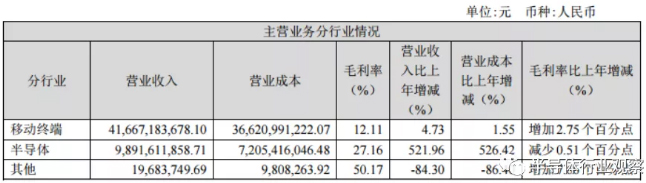

At the same time, through the acquisition of Anshi Semiconductor, Wingtech's revenue in the semiconductor field has also made significant progress. According to data from its 2020 annual report, Wingtech’s semiconductor business achieved revenue of 9.89 billion yuan in 2020, a sharp increase of 521.96% year-on-year.

On this basis, in July last year, Wingtech Technology issued an announcement stating that its 5.8 billion yuan fixed increase project was completed at a premium. According to its fixed growth plan, Wingtech’s funds raised are mainly used in Anshi China’s advanced packaging and testing platform and process upgrade projects, Yunsi Zhigu 4G/5G semiconductor communication module packaging and testing, and terminal R&D and industrialization projects (Wingtech Kunming Intelligent Manufacturing Industrial Park (Phase I)). It can be seen from this that Wingtech is trying to expand its advantages in the semiconductor field.

This year, Wingtech’s Anshi Semiconductor will obtain 100% ownership of the NWF fab, which is another new move for them to expand in the semiconductor field, especially in the automotive semiconductor field. According to the NWF official website data, the current NWF's maximum production capacity can be expanded to 44,000 8-inch wafers per month. It is mainly engaged in the manufacture of semiconductor chips with a 0.18μm-0.7μm process process. The main products are MOSFET and IGBT chips used in the automotive industry. And CMOS, analog chips. In addition, NWF also possesses compound semiconductor (mainly SiC and GaN) development capabilities.

Foxconn has been making new moves in the field of wafer manufacturing and packaging and testing in recent years. In the middle of this year, according to a report in the Wall Street Journal, Foxconn announced the acquisition of Hongwang's 6-inch wafer fab to deploy the automotive chip field. It is reported that the 6-inch wafers produced by the factory are mainly used to manufacture key SiC power components in electric vehicles. .

When it comes to transformation, we have to mention Weil shares. After acquiring chip manufacturers such as Howe and Spyco, Weil shares have formed image sensor products, touch and display driver integrated chips and other semiconductor devices. The product is an enterprise with the core products of the junior college.

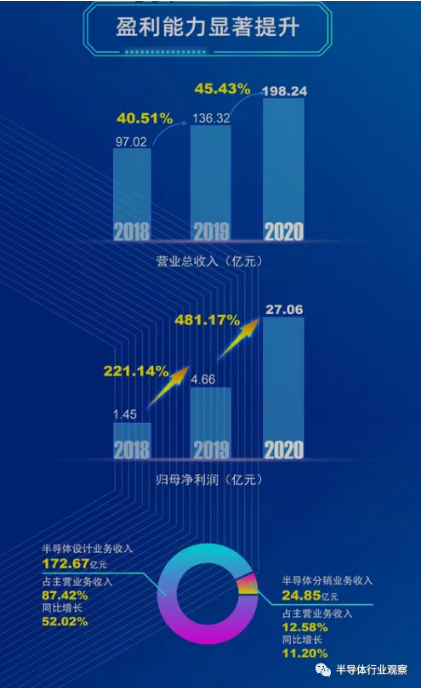

Through the acquisition, Weil shares have also achieved rapid growth in revenue-according to the 2020 financial report released by Weil shares, from 2018 to 2020, Weil shares' operating income has risen from 9.702 billion yuan to 19.824 billion yuan Yuan, the annual revenue growth has been maintained at more than 40%. In terms of revenue composition in 2020, the revenue of Weir's transformed semiconductor design business also exceeded the revenue of its traditional business (semiconductor distribution business), achieving revenue of 17.267 billion yuan, accounting for total revenue. 87.42%. Obviously, the semiconductor design business has become the main source of revenue for Weir shares.

(Weir shares profitability picture source: Howe Technology's official WeChat)

In addition to these types of companies, many domestic home appliance companies are also trying to move closer to the chip field. Among them, TCL is also one of the representatives of the transition to the semiconductor field. Semiconductor Industry Observation In the previously published article "TCL's Pan-Semiconductor Ambition", he also checked the company's semiconductor business layout.

From these new forces in the transformation and development of the semiconductor business, their previous accumulation in various fields has provided them with capital to enter the semiconductor industry. Through acquisitions, these transformed companies have quickly obtained visible profits in the semiconductor field. . As for the domestic semiconductor industry, the development of these system manufacturers in the semiconductor field may greatly promote the development of localization of chips.

In addition to these cross-border companies whose focus business has begun to develop into the semiconductor field, companies involved in some semiconductor businesses are also undergoing transformation. Most of the transformation of these companies is to adapt to the development of emerging applications. Driven by new demands, Such companies have begun to carry out multi-line layouts.

Sanan Optoelectronics is one of them. They once stated in the 2020 semi-annual report that domestic compound semiconductor integrated circuits have a broad market space and huge development potential, and they are currently in the take-off stage of the industry. Therefore, they have also carried out a comprehensive layout for compound semiconductors. Last year, Sanan Optoelectronics announced that the company will invest 16 billion yuan in cash to establish a subsidiary in Changsha to invest in the construction of a third-generation semiconductor industrial park.

In combination with the current domestic third-generation semiconductor market that is mainly dominated by foreign companies, Sanan's development of compound semiconductors is also seen as an opportunity to promote domestic substitution. According to the company's interim report last year, the company has achieved a breakthrough in the number of customers shipped. As of the first half of 2020, the company has shipped nearly 100 GaAs customers, and the production capacity of important customers for gallium nitride radio frequency products is gradually increasing.

Judging from the "core" forces of these transformations, these companies have made obvious progress in the development of semiconductor business. From another perspective, their emergence has also given rise to the development of the domestic semiconductor industry and the development of localization. Enter the key.

Traditional semiconductor companies that cannot be ignored

Of course, in addition to new forces in the domestic semiconductor industry, market demand has also brought development opportunities for traditional semiconductor manufacturers in the domestic market. The upgrading of traditional semiconductor companies is also a mainstay in the development of the domestic semiconductor industry.

The upgrading of traditional semiconductor companies in my country can be divided into two parts. On the one hand, they are upgrading their technology and products based on their own strength in order to adapt to the development of emerging fields. On the other hand, they are upgrading in chip manufacturing. upgrade.

The upgrading of technology is an important task given to every semiconductor manufacturer in this era. In the field of foundry, domestic manufacturers represented by SMIC are launching an attack on more advanced processes; in the field of packaging and testing, Changjiang Electronics Technology Domestic manufacturers, represented by Tongfu Microelectronics, and Tianshui Huatian, are also deploying advanced packaging technologies that the current market attaches importance to; in the field of chip design, manufacturers represented by Huawei, Ziguang Group and other companies are gradually shrinking and competing with international chip giants. The gap between...

In a more segmented market, Chinese chip manufacturers have also made continuous breakthroughs in many areas. For example, in the field of analog chips and MCUs, domestic manufacturers have also begun to expand into more fields based on their original products. All have good performance. In our previous article "The Breakthrough of Chinese Chip Manufacturers", we have also seen the development of some traditional semiconductor manufacturers in the subdivision field, which have already seized a certain share, and this also shows that the strength of Chinese chip manufacturers has been affected by the market. Recognized.

In terms of chip manufacturing, what we are talking about here is not the progress of foundries or packaging and testing companies, but some domestic chip manufacturers are moving closer to the IDM model, and their layout in chip manufacturing.

The reason that prompted domestic manufacturers to deploy chip manufacturing capabilities. In the article "The Era of Chip Shortage, IDM Advantages Highlighted", experts pointed out that for some areas, the chip shortage is expected to continue until at least 2023, which means that we are very For a long time, it will be necessary to cope with the dilemma of global supply shortages. The IDM (Vertical Integrated Manufacturing Factory) model is a feasible solution that can help relieve a certain degree of pressure.

In the long run, the reason why domestic chip manufacturers have begun to deploy chip manufacturing capabilities is the increase in customized chips. Judging from the current market situation, the purpose of many companies' self-developed chips is not to reduce costs, but to bring quality improvement and differentiated products through self-developed chips to their main business. And we all know that packaging technology has become one of the important technologies that can achieve product differentiation when the development of advanced processes encounters bottlenecks. Therefore, the development of vertical integrated manufacturing may be able to better leverage the advantages of products.

Especially for some sub-fields, such as CIS, power devices and other fields, in these fields that do not require the most advanced technology to support, the special processes they use have also been one of the sources of revenue for foundries in recent years. . With the increasing demand for power devices and other products in emerging applications, these manufacturers have also brought opportunities to move towards IDM.

Taking the field of power devices as an example, in the article "The "Counter-trend" of IDM in Foundry Transformation" published by the semiconductor industry, the reason behind China Resources Micro's switch to IDM mode was written-China Resources Microelectronics public information shows that its adoption The IDM business model is mainly because power semiconductors and other products need to be more closely integrated with design, R&D, manufacturing and packaging processes. The IDM business model can better integrate internal resource advantages, which is more conducive to the accumulation of technology and the formation of product groups, and is carried out according to customer needs Efficient special craft customization. At the same time, based on the abundant production resources in wafer manufacturing, packaging and testing, it can also meet the production needs of its own products and use it to serve other companies in the semiconductor industry.

is written at the end

On the whole, the emergence of emerging applications has promoted the resurgence of the global semiconductor industry. Among them, China, as one of the markets that can provide conditions for the development of emerging applications, also has a greater demand for semiconductors, which in turn promotes the domestic semiconductor industry. The development of this has also stimulated a group of start-up companies to look for opportunities under the demand of emerging applications.

On the other hand, the development of digitalization has become a trend, and the arrival of digitalization is more dependent on semiconductors. This has also made the competition around the semiconductor industry more intense, and the calls for localization have also increased. Accompanied by the appearance of this voice, it also means that domestic semiconductor companies will usher in new market opportunities, and in this way, it is more likely to bring some changes to the semiconductor industry. Therefore, under this trend, domestic semiconductor companies have grown both in terms of quantity and investment.

Looking back, whether it is the new power brought by start-ups and transformation companies to the domestic semiconductor industry, or the backbone of traditional domestic semiconductor manufacturers, Chinese semiconductor companies pursued from multiple paths, which have brought about the development of the domestic semiconductor industry. With new vitality, perhaps their roles in the domestic semiconductor field are different, but it cannot be denied that their many attempts in the semiconductor field will be opportunities for the future development of my country's semiconductor industry. But this road is obstructive and long.

Scan the QR code to read on your phone

Related News

Official account